C.H. Robinson Worldwide's Bullish Breakout: A Technical and Fundamental Analysis

Unveiling a Classic Cup & Handle Pattern in CHRW

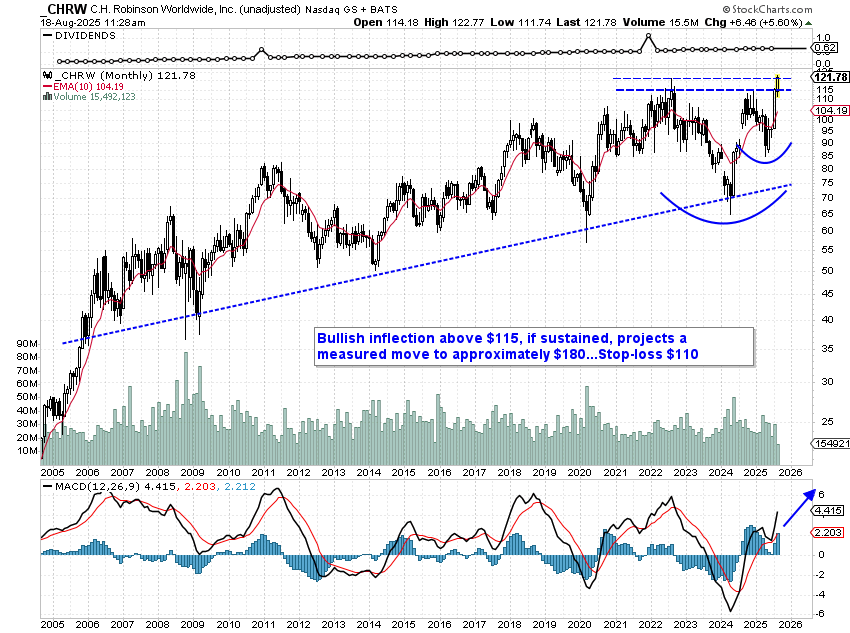

C.H. Robinson Worldwide, Inc. (CHRW) has recently captured the attention of investors and traders by breaking above a critical resistance level, forming a classic "Cup & Handle" pattern on its technical chart. This breakout suggests a potential bullish trend, projecting a significant upside if the stock sustains its momentum. This article delves into the implications of this breakout, the company's current financial standing, and the strategic outlook for investors considering CHRW as a part of their portfolio.

Key Takeaways:

Technical Breakout: CHRW has surpassed a pivotal resistance level at $115, forming a "Cup & Handle" pattern, suggesting a bullish trajectory towards $180.

Risk Management: A disciplined stop-loss set at $110 limits downside risk to approximately 9.8%, offering a favorable 5:1 reward-to-risk ratio.

Company Strengths: As a leading third-party logistics provider, CHRW benefits from a robust carrier network and technological prowess, positioning it well for cyclical recovery.

Financial Performance: Despite market challenges, CHRW maintains strong earnings and cash flow, supported by strategic cost management and technology investments.

Investor Strategy: The technical setup, coupled with a resilient business model, presents a compelling opportunity for investors seeking asymmetric risk/reward potential.

Technical Outlook: Cup & Handle Breakout

Pattern Analysis

The "Cup & Handle" is a well-regarded bullish continuation pattern in technical analysis. It typically forms after a long consolidation period, indicating a potential uptrend if the breakout above the "handle" is sustained. In CHRW's case, this breakout occurred above the $115 neckline, setting the stage for a move towards the projected target of $180.

Breakout Level (Neckline): $115

Measured Target: ~$180 (representing a potential 56% upside from the breakout)

Stop-Loss: $110 (limiting downside to ~9.8%)

Risk/Reward Ratio: 5:1 (for every $1 risked, $5 potential reward)

Implications for Investors

A sustained move above $115 reflects strong buying interest and could mark the beginning of a new uptrend phase for CHRW. The risk-managed setup, with an attractive reward-to-risk ratio, is particularly appealing to traders and investors seeking to capitalize on technical patterns. The combination of a clear breakout and disciplined risk management enhances the potential for favorable returns.

C.H. Robinson Worldwide: Company Profile

Sector Overview

C.H. Robinson Worldwide is a prominent player in the transportation and logistics sector, specializing in third-party logistics (3PL) services. The company offers a comprehensive suite of freight transportation, logistics, and information services globally, leveraging its extensive carrier network and advanced technology platforms.

Business Model:

Provides truckload, less-than-truckload (LTL), ocean, air, and customs brokerage services.

Operates across major markets, including North America, Europe, Asia, and more.

Known for its "People Plus Tech" strategy, combining human expertise with cutting-edge technology.

Key Strengths

CHRW's strategic strengths lie in its ability to adapt to changing market dynamics and leverage its technological investments. The company's diversified client base and global reach provide resilience against regional market fluctuations, while its carrier network ensures competitive service offerings.

Recent Financial Results

The financial health of CHRW supports the technical bullish outlook. The company's recent financial performance highlights its ability to navigate challenging market conditions while maintaining strong profitability and cash flow generation.

Metric | Value (most recent) | Commentary |

|---|---|---|

Revenue | $238.1B | Stable, but topline growth remains muted |

Net Income | $7.63B | Solid profit despite freight market softness |

Operating Income | $10.42B | Margin expansion via cost discipline |

EPS (Diluted) | $59.24 | Strong earnings per share |

Cash Flow from Operations | $8.84B | Healthy operational cash generation |

Dividend (quarterly) | $0.61/share | Consistent, reliable payouts |

Recent Developments

Cost Management: CHRW's focus on cost discipline and technology investments is driving margin improvements, even as freight volumes and revenues remain under pressure.

Management Strategy: Structural cost savings and strategic investments position the company for growth once the freight cycle recovers.

Outlook & Forecast

While the short-term outlook may be tempered by current market challenges, CHRW's strategic positioning offers significant upside potential in the medium to long term.

Short-term

Technical Indicators: Bullish momentum if the stock remains above $115.

Market Conditions: Near-term growth may be limited by freight market overcapacity and weak volumes.

Medium/Long-term

Cyclical Recovery: A leaner cost structure and strategic investments position CHRW for outsized earnings leverage when the freight cycle turns.

Market Share Gains: Continued focus on technology and cost efficiencies will support market share expansion.

Forecast Driver | Outlook |

|---|---|

Freight Market | Challenging near-term, recovery potential in 2025 |

Cost Structure | Improved, margin upside when cycle turns |

Dividend Policy | Stable, with room for increases if FCF improves |

Risk/Reward Summary

Upside: $180 target (if pattern plays out)

Downside: $110 stop-loss (~9.8% risk)

Reward/Risk: 5:1 (very attractive for active investors)

Catalysts: Freight cycle recovery, further cost efficiencies, tech-driven market share gains

Bottom Line:

C.H. Robinson Worldwide's technical breakout, combined with disciplined risk management and a fundamentally resilient business, offers a compelling opportunity for investors. The 5:1 risk/reward skew is especially notable, though near-term results may remain muted until the freight market improves. This is a high-conviction technical trade with solid long-term fundamentals. For further insights and analysis, investors are encouraged to explore more on DeepStreet.io and integrate these insights into their investment strategy.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)