XLY Catches Up: A New Bullish Signal in the Consumer Discretionary Sector

Exploring the Consumer Discretionary Sector's Recent Bullish Transition and What It Means for Investors

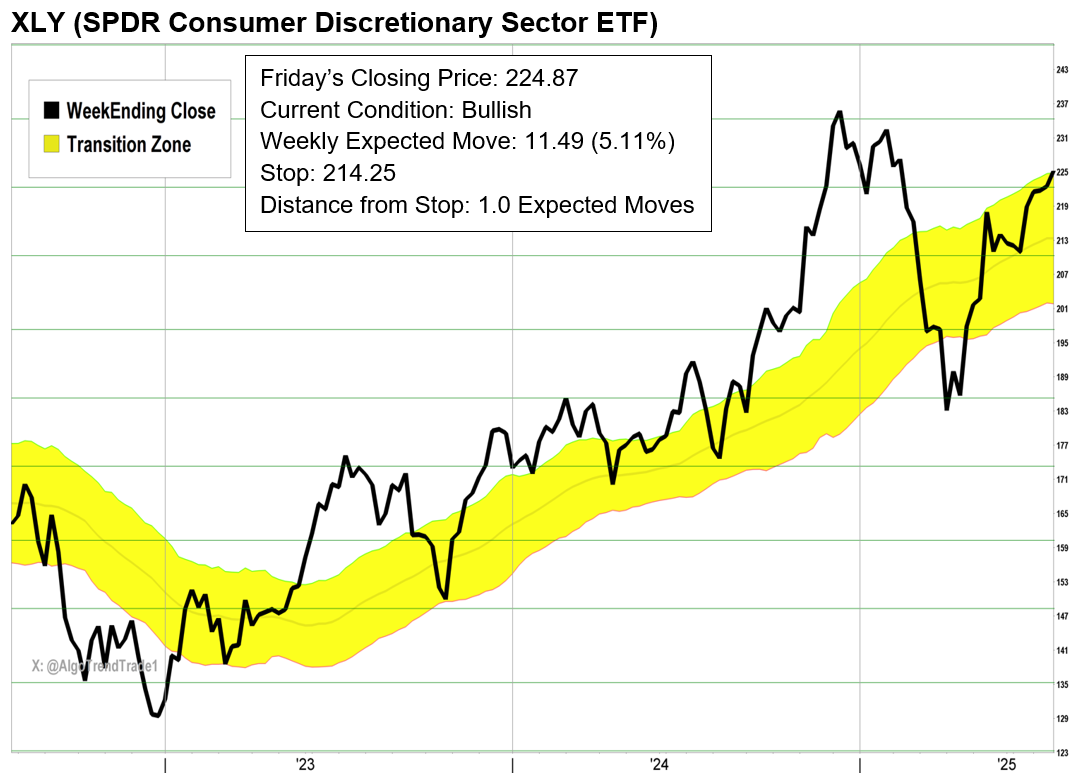

The Consumer Discretionary Select Sector SPDR Fund (XLY) has recently transitioned from a neutral stance to a bullish one, aligning itself with the ongoing bull market. This shift not only signals renewed momentum for the sector but also serves as a pivotal entry point for trend-following investors. Here's an in-depth look at this development and its potential implications for your investment strategy.

Key Takeaways:

Bullish Transition: XLY's movement from neutral to bullish marks a significant catch-up with the broader bull market.

Market Breadth: The shift indicates a broader sector participation, enhancing the sustainability of the bull market.

Strategic Entry Point: This is an ideal moment for investors using trend-following strategies to consider new positions.

The Bullish Turn in Consumer Discretionary

New Bullish Signal

On July 28, 2025, XLY officially moved to a bullish status in the sector-based trend analysis. This change is an indicator of the market's broader bullish sentiment extending to the consumer discretionary sector, which includes key players like Amazon, Tesla, and Home Depot.

Broader Market Participation

Sector Analysis: With XLY joining the list of bullish sectors, the S&P 500 now exhibits increased market breadth. This development suggests that the bull market is no longer driven solely by a few sectors like technology, financials, and industrials.

Current Sector Landscape:

Consumer Discretionary (XLY): Bullish

Technology (XLK): Bullish

Financials (XLF): Bullish

Industrials (XLI): Bullish

Communications (XLC): Bullish

Utilities (XLU): Bullish

Implications for Trend-Followers

The transition of XLY into bullish territory offers a clear entry signal for trend-following investors. Such signals are crucial for those seeking to capitalize on market momentum while managing risk effectively.

Why XLY's Bullish Shift Matters

Momentum and Market Breadth

The breakout of XLY into bullish territory enhances the momentum of consumer discretionary stocks, which are often seen as indicators of investor confidence in economic growth. This sector's performance is critical as it reflects consumer spending trends, a major driver of economic activity.

Healthier Market Dynamics

With more sectors joining the bullish trend, the market's reliance on a few sectors diminishes, leading to a more balanced and sustainable rally. This broad participation is a positive sign for the overall health of the bull market.

Trading Implications

For investors adhering to trend-following strategies, the new bullish signal from XLY presents an optimal opportunity to initiate or augment positions. The key to capitalizing on this signal lies in stringent risk management, including setting stop-loss levels based on current market volatility and expected moves.

Practical Strategies for Investors

Optimal Entry Timing

Initial Positions: The best time to enter is at the onset of a new signal. However, if entering later, consider reducing position sizes to mitigate risk.

Risk Management

Stop-Loss Strategies: Implement stop-loss orders based on the recent volatility of the ETF. Tools like "Expected Move" calculations can be effective in setting these limits.

Focus on Top Holdings

Key Stocks: XLY's largest holdings, such as Amazon (24% of the ETF), Tesla (15%), and Home Depot (6.7%), will play a significant role in its future performance. Monitoring these stocks can provide additional insights into the ETF's trajectory.

A Summary of XLY's New Bullish Signal

Date | Previous Status | New Status | Implication |

|---|---|---|---|

July 28, 2025 | Neutral | Bullish | Entry signal for trend-followers |

Looking Ahead:

XLY's alignment with the bull market and its new bullish signal present a promising opportunity for investors seeking to diversify their portfolios and leverage sector momentum. By incorporating disciplined risk management and strategic entry points, investors can enhance their exposure to this key sector while mitigating potential downsides. Explore more insights and strategies on DeepStreet.io to stay ahead in the ever-evolving market landscape.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)