A Semiconductor Leader on the Rise

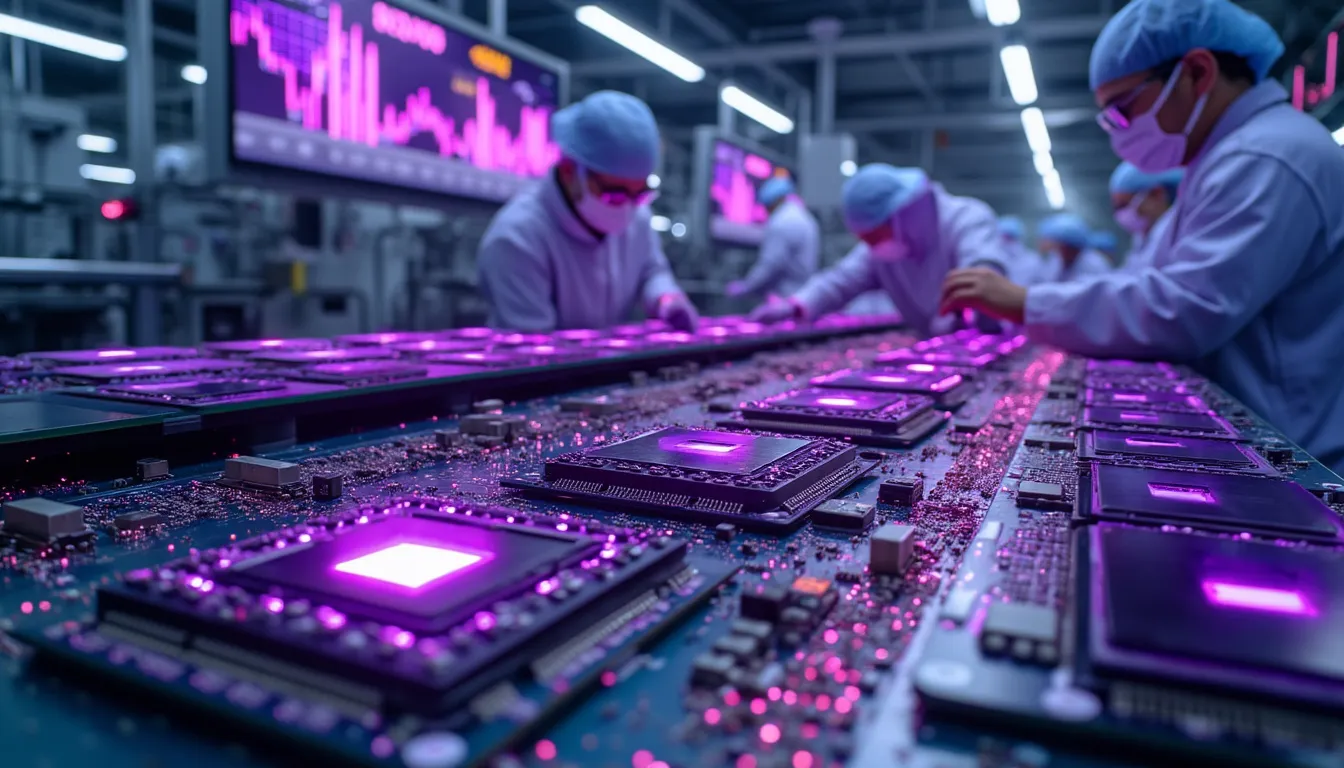

Advanced Micro Devices, Inc. (NASDAQ: AMD), a global semiconductor giant, has emerged as a standout performer in today's trading session with a notable increase of 3.418%, reaching a price of $117.92. This surge comes amid a challenging environment for the broader market, highlighting AMD's resilience and potential for growth. As a leader in high-performance computing, graphics, and visualization technologies, AMD's recent performance underscores its pivotal role in driving technological advancements.

Key Takeaways:

Percentage Change & Volume: AMD's stock rose by 3.418% with a robust trading volume of 24,301,724 shares, indicating strong investor interest.

Sector Leadership: AMD's performance outpaces the broader technology sector, showcasing its potential as a market leader.

Recent Collaborations: AMD's collaboration with Ocient aims to enhance power efficiency and performance for data and AI workloads, potentially driving future growth.

Performance in Focus: A Close Look at AMD's Recent Surge

AMD's current market performance is a testament to its strategic initiatives and robust business model. The stock opened at $114.17 and saw a significant climb to $117.92, reflecting investor confidence in its growth strategies and technological innovations.

Historical Stock Performance

Over the past year, AMD has demonstrated resilience amidst market fluctuations, maintaining a strong upward trajectory. This consistent performance is bolstered by strategic partnerships and product innovations, positioning AMD as a formidable competitor in the semiconductor industry.

Analyst and Market Sentiment: A Positive Outlook

Recent market sentiment reflects a positive outlook for AMD, with analysts projecting continued growth driven by the company's strategic initiatives and expanding market presence. The collaboration with Ocient is a notable development, poised to enhance AMD's capabilities in addressing the growing demand for efficient data and AI solutions.

Recent News Highlights

Ocient Collaboration: AMD's partnership with Ocient is set to deliver a 3.5X increase in processing power and over 2X increase in memory throughput, strengthening its position in the data and AI markets.

Market Anticipation: Analysts suggest that AMD investors should be prepared for significant developments, as highlighted by a recent Motley Fool report.

Conclusion: AMD's Strategic Positioning in the Technology Sector

AMD's impressive performance amidst a volatile market underscores its strategic positioning and robust growth potential within the technology sector. As the company continues to innovate and expand its partnerships, it remains a compelling prospect for investors seeking exposure to cutting-edge technological advancements. With a strong focus on enhancing performance and power efficiency, AMD is well-positioned to capitalize on emerging opportunities in the semiconductor industry.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)